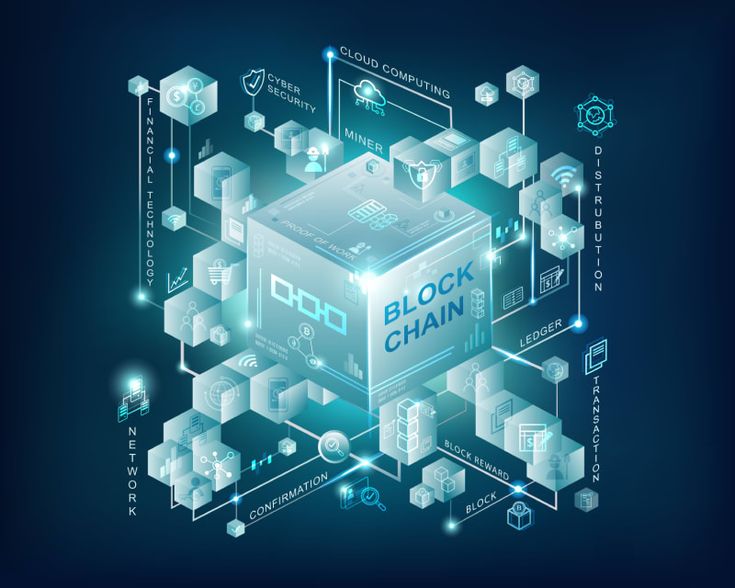

Financial regulation, securities legislation, taxes, privacy, property rights, and criminal law are just a few of the many domains that have been touched by the many legal ramifications brought about by cryptocurrency and blockchain technology. Some of the most important things to keep in mind from a legal standpoint while dealing with blockchain and bitcoin are:

1. Financial Regulation: The global financial authorities are facing a plethora of complicated regulatory concerns brought about by cryptocurrencies like Ethereum and Bitcoin. Cryptocurrencies have been the subject of scrutiny from regulators and enforcement actions due to questions about their classification as currency, commodities, securities, or property. Additionally, there are concerns about the licensing requirements to feed cryptocurrency exchanges or custodians, as well as anti-money laundering (AML) or understand who you are (KYC) regulations, as well as consumer protection measures.

2. Securities Law: With the rise of ICOs and token sales, blockchain companies have found a popular way to raise funds. On the other hand, if tokens are seen as contracts for investments or securities offerings, their sale and issue might be subject to securities regulations. Compliance with regulatory regulations is crucial, since enforcement actions have been taken against initial coin offerings (ICOs) that violate securities laws by regulatory authorities including in the USA (SEC).

The third point is taxes. How cryptocurrencies are taxed depends on a number of criteria, including their categorization, their use (as a payment method, an investment, or a currency), and the length of time that one holds onto them. Cryptocurrency taxation has been the subject of international tax authorities’ pronouncements on topics such reporting prerequisites for cryptocurrency transactions, taxation of profits on mining and trading, and capital gains tax.

Fourthly, data and privacy are safeguarded by blockchain technology’s decentralized ledger system, which provides immutability and transparency. Nevertheless, new worries over data safety and privacy have surfaced, especially in blockchains that are publicly accessible where all participants may see the specifics of transactions. Blockchain applications may come into conflict with regulatory frameworks that mandate the legitimate handling and safety of personal data, such as the GDPR, or the General Data Protection Regulation, of the European Union.

Fifthly, IP: Smart contracts & decentralized apps (DApps) are two areas where blockchain technology might affect IP rights. Legal professionals and lawmakers face novel obstacles in decentralized settings when attempting to resolve issues like code ownership, licencing agreements, patent protection to blockchain developments, and enforcement of IP rights.

6. Compliance with Criminal Law: Cryptocurrencies have a history of being linked to illegal acts including cybercrime, fraud, money laundering, and terrorism funding. Through increased monitoring, enforcement measures against illegal exchanges, and international collaboration, regulatory bodies and law enforcement agencies have ratcheted up their efforts to tackle crypto-related crimes. Companies dealing in cryptocurrencies now face more onerous compliance requirements, particularly with regard to anti-money laundering (AML) & counter-terrorism financing (CTF) laws.

Finally, as blockchain and cryptocurrencies develop and become more widely used, their legal ramifications are complex and ever-changing. Finding regulatory solutions that promote innovation while also protecting investors, maintaining financial stability, and advancing public interest goals is a formidable problem for lawyers, legal professionals, regulators, and lawmakers.